Creating Sustainable Value

At Sparring Capital, we see sustainability as an opportunity for innovation, growth, and differentiation.

With our portfolio companies, We Are Building the World of Tomorrow

In a world in transition, we support our portfolio companies as they adapt their growth models to become more innovative, eco-friendly, and resilient. Together, we work to integrate circular economy principles into their operations, optimize resource efficiency, reduce emissions, and promote a sustainable value chain that addresses ethical, social, and environmental issues. With our support and our specialists expertise, their teams are fully committed to driving there transformative changes.

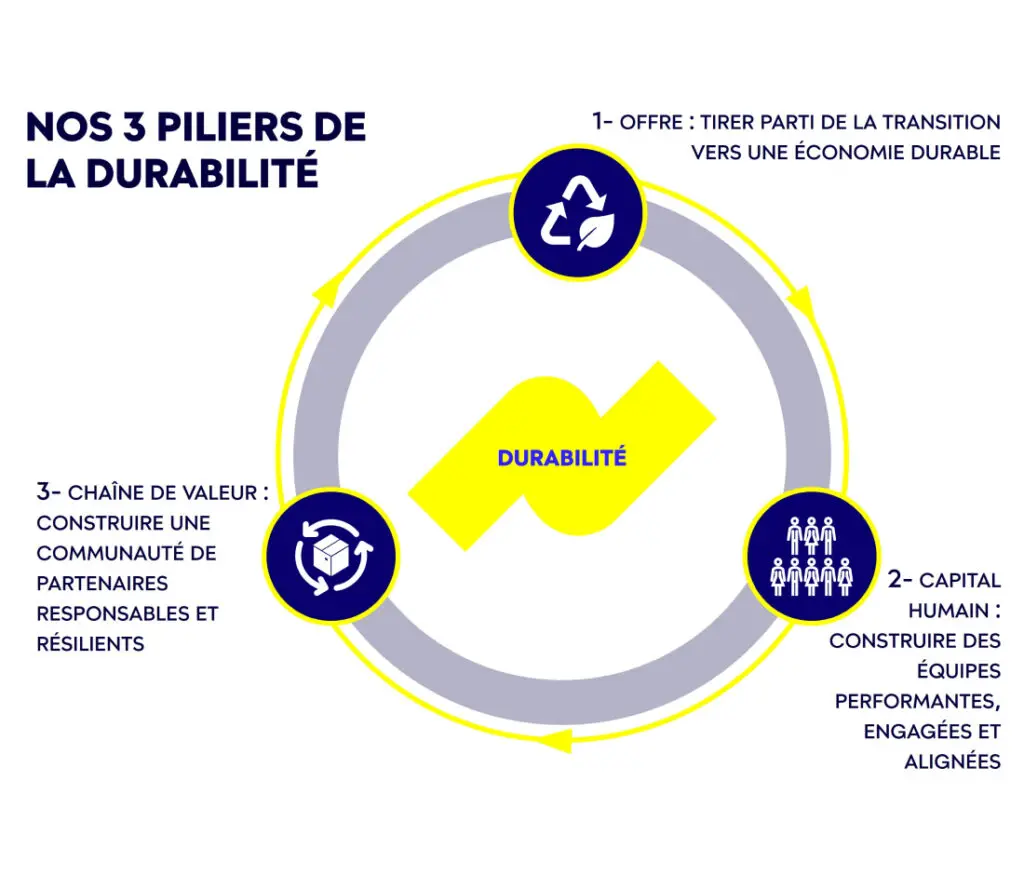

Sustainability as a Driver of Value Creation

We view sustainability a powerful engine of growth and work with our portfolio companies to unlock its full potential. To achieve this, we base their CSR strategy on three core pillars of sustainability: developing a range of products and services that support the transition to a sustainable economy, building high-performing, engaged, and aligned teams, and creating a network of responsible and resilient business partners. These pillars empower us to foster long-term sustainable and responsible growth.

CSR Support for Our Portfolio Companies

Throughout Our Partnership

Internal Analysis

- Compliance with Exclusion Policy

- Identification of Key Sustainability Issues

- Assessment of Climate Maturity

- Identification of Decarbonization Levers

Due Diligence

- ESG Risk and Opportunity Analysis, Aligned with European Sustainability Standards

- Assessment of Climate Risks and Opportunities

- Evaluation of Biodiversity Impacts and Dependencies

- Identification of Eco-design and Decarbonization Levers

Integration

- Appointment of an ESG Manager

- External Assessment (e.g., Ecovadis)

- Carbon Footprint Evaluation

- Life Cycle Analysis

- External Review of ESG Approach and Development of a Climate Action Plan

- Implementation and Monitoring of the Climate Action Plan over 5 Years

Monitoring

- Tracking of the Action Plan’s Progress

- Annual Carbon Footprint Update

- Annual Collection of CSR Data, Including PAIs, and ESG Performance Evaluation

- Climate and Sustainability Issues Addressed during the Supervisory Board

Measuring Progress

- Carbon Footprint Assessment (Scopes 1, 2 3)

- Sustainability and Climate Information as part of the Divestment Note

- Inclusion of ESG and Climate Elements in the Information Memorandum

- Conducting an ESG Vendor Due Diligence (VDD)

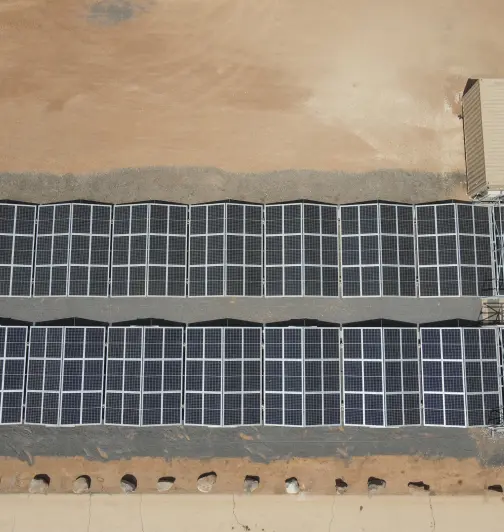

NovaKamp - Sale of a Hybrid Power Plant in an Off-Grid Site

NovaKamp invests 3% of its revenue to develop energy production methods that realease less CO2.

SMM Composite - Decarbonizing Maritime Transport

Leveraging its expertise in composites, SMM implements sailing propulsion solutions for both passenger transport and cargo ships.

Decarbonization as a Growth Driver

Our climate commitments involve collaborating with the companies in our portfolio and carefully deploying the following resources: climate risk and opportunity analysis, annual calculation and monitoring of the carbon footprint, and development of sustainability roadmaps that include decarbonization actions. We ensure clear and transparent communication about the progress made, regularly relying on key performance indicators, both at the portfolio and company levels a.

Climate Figures

Our commitments and actions regarding sustainability can demonstrate our positive environmental and societal impact.